Learn how to maintain confidence and stay focused on your long-term financial goals during market fluctuations.

Feeling the market jitters? Let's talk. Watching the market bounce around can be nerve-wracking, especially when it's your hard-earned money on the line. At Talisman, we totally get it. We've been helping people like you – entrepreneurs, busy executives, and people getting ready to enjoy retirement – navigate these ups and downs for over 30 years. We've seen it all, trust me.

Lately, we've been hearing a lot of the same question from our clients: "What's going on with the market, and what should I do?" So, let's tackle that head-on. The first step to feeling more confident about your money is understanding how the market actually works.

The Market's Got a Rhythm (and It's Not Always Smooth

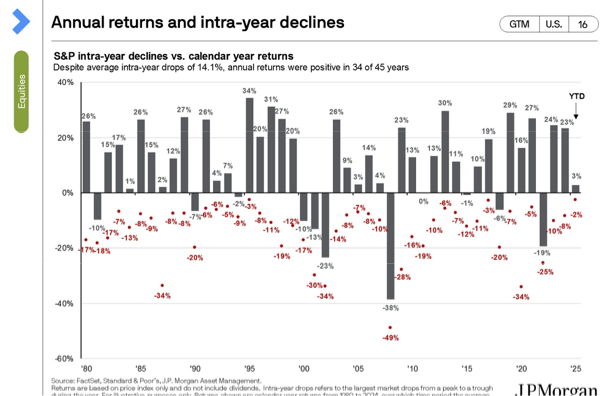

Here's something that might help you sleep a little better: market swings aren't a mistake. They're just part of the deal. Think of it like the seasons – there are ups, there are downs, and it's all part of a natural cycle. When you realize that, it's easier to keep a cool head when things get bumpy.

Building a Portfolio That Can Weather Any Storm

Imagine your investment portfolio as a really well-built ship. It needs to be strong enough to handle rough seas, but also quick enough to catch the wind when it's blowing in the right direction. That's where diversification comes in.

Diversification: Not Just a Fancy Word

Diversification isn't just some financial jargon we throw around. It's your personal force field against market craziness. But here's the secret: it's not just about spreading your money around. It's about creating a mix of investments that makes sense for you – your comfort level with risk, and how long you have until you need the money.

Getting Ready for the Good Life: Retirement Planning

If you're getting close to retirement, we've got a special plan to help protect your nest egg. We like to build in a safety net of stable investments, including:

✓ Solid, High-quality bonds: Think of these as your steady paycheck.

✓ Dividend-paying stocks: These can help your money grow over time and you get paid while you wait.✓ Cash on hand: Reserves just in case you need it.

This balanced approach helps make sure that a market dip doesn't throw your retirement plans off course.

Leaving a Legacy: Protecting Your Family's Future

If you're thinking about passing wealth down to future generations, market ups and downs are like a test of your family's financial foundation. The goal is to build something that can withstand those fluctuations and actually get stronger over time.

Planning for Generations to Come

We help families do this by:

- Setting up clear family guidelines for managing wealth.

- Creating a smart mix of investments for the long haul.

- Making sure everyone's on the same page with regular family talks about money.

- Finding smart ways to minimize taxes when transferring wealth.

The Long View: Your Family's Financial Story

Instead of panicking about every market dip, try to see it as just one chapter in your family's financial story. This helps you make smart, strategic decisions instead of emotional ones.

Ready to Chat About Your Investment Strategy?

Market volatility doesn't have to be a constant worry. Our team is here to help you create a plan that fits your life, your goals, and your values.